Borrowing to buy shares in smsf

Simple superannuation and retirement planning information.

SMSF Investments: Using Your Super Fund To Invest In Shares | SMSF Experts

May 31, by Trish Power 3 Comments. As a property and share investor for nearly 30 years, I believe the use of borrowing can be a legitimate means to purchase assets, but gearing is not an investment in itself: Over the years, I have spoken to thousands of Australians about super and finance and they share their stories with me about good and bad investments. A margin loan is a borrowing arrangement to purchase shares, and the shares are used as security for the loan.

SMSFs cannot use margin loans. My investment alarm bell was ringing loudly in my head when I asked her what she had invested in with her borrowed money.

Borrowing to buy shares, why do it & how to do it sensibly with Cathy KovacsAs it turned out, her money was invested in one shareholding and after some digging we discovered that she had invested in one of those companies that imploded during late The woman has nothing to show for her so-called investment, and she had to take out a larger mortgage on her house to repay the margin loan.

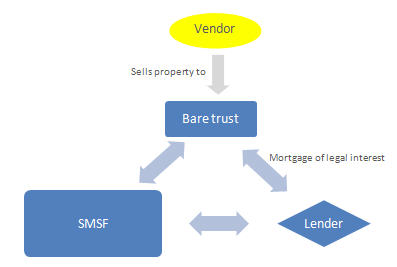

The financial tragedy for this woman is that she now has a bigger mortgage because of her financial misunderstanding. The ability to indirectly borrow money has opened up the possibility of direct property investment.

If the government had made the decision to ban SMSF borrowing then in my view it would have simply been a retirement policy decision, rather than a systemic risk decision. I personally hold a neutral view on whether super funds should be permitted to borrow.

You can expect to read a lot of hype and hoopla about gearing within SMSFs, as if the act of gearing is an investment in itself.

My reservations about some of the limited recourse borrowing products on the market is that investing in this way is expensive and you have to do your sums about the net benefit of such an investment approach. You need to ask: Is the expected return on the property behind the borrowing arrangement going to exceed the annual interest costs, any management charges, and any additional establishment and add-on costs that the product promoter is going to charge?

Using borrowed money to invest can be a popular way to accelerate wealth accumulation. Borrowing to invest is also known as gearing, and in its simplest form involves an individual outside of super borrowing money to buy an income-producing asset. The income earned from the geared asset is then used to cover the expenses in purchasing and maintaining the asset, including repaying the loan.

If the costs of investing, including interest payments, are greater than the income earned on the asset, individual taxpayers can then offset other income for tax purposes with the loss on the geared investment. Borrowing to invest is a higher-risk strategy that relies on the investment returns or tax benefits associated with such a strategy outweighing the interest costs. Any loan that you take out still has to be repaid, which means the returns and tax benefits on that geared investment would at least have to deliver the costs of borrowing money to make the strategy worthwhile.

A major advantage of gearing is the ability to invest in more investments, or in an asset that is worth a greater amount of money, because you have more money to invest. Taking such an aggressive approach can increase your investment earnings if the value of your investment portfolio increases.

A distinct drawback of gearing, however, is that using such a strategy can dramatically increase your losses when the value of the investment portfolio falls. When borrowing to invest, the assets that you invest in are usually used as security for the loan, which means the bank has an interest in the investment.

The arrangement is simply that — an arrangement, rather than an investment. You, or the product promoter offering the borrowing product, have to select a suitable property investment for your fund. The borrowing arrangement then enables that investment to take place. For example, you may be able to access a product that enables your SMSF to invest in residential property, provided you have 25 per cent of the purchase price plus enough cash to cover buying costs, including stamp duty.

Another product on the market allows a SMSF to buy commercial property, provided the SMSF can cover 45 per cent of the purchase price plus buying costs. When property values are rising, geared products enable to you to accumulate wealth at a much faster rate because you have access to the returns on more assets.

In falling markets, however, your losses are also greater when you borrow to invest. What matters when investing, whether you use borrowed money or not, is the quality of the underlying property investment. You also need to be mindful of the costs of such an arrangement. For recent ATO guidance on LRBAs financed by related parties, rather than banks or other financial organisations, see ATO links below:. For more information, see SuperGuide article SMSF borrowing: January 30, at The bank cannot proceed directly against the matrimonial home but rather against the mum and dad guarantors.

To discharge the debt they, in turn, may need to sell the matrimonial home.

How instalment warrants help in SMSF borrowing to buy shares | pupuzifecose.web.fc2.com

November 2, at 1: I totally agree with your comments — limited recourse borrowings should only be used as a tool to leverage conservatively an already high quality investment. As any astute property investor knows, cash flow is critical. The same rules apply to geared property investment with a SMSF than non-SMSF property investments:. I to have seen people make bad investment decisions — and a lot of the time it is simply a lack of education and understanding.

Hopefully your articles and others like it will help increase investor education and confidence. To my knowledge all banks now demand the Individual trustees execute a bank guarantee for the loan amount.

Note the trustee need to sign in their personal capacity. This guarantee stands outside the super rules.

This exposes the individual mum and dads to recovery against their matrimonial home which is probably the last thing a couple in their 60s should be doing. Bear in mind that the bank need not proceed against the secured asset by way of a power of sale. In law the bank can proceed directly against the matrimonial home under the guarantee and simply ignore the investment property.

More than likely if the matrimonial home has no mortgage attached. Your email address will not be published. SuperGuide was founded by Trish Power, author of Superannuation for Dummies, DIY Super for Dummies, Super Freedom, Age Pension made simple, and many other books on super and investing , and Robert Barnes.

All information on SuperGuide. It is important to seek professional accredited financial advice when considering whether the information is suitable to your personal circumstances. Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer SuperGuide Simple superannuation and retirement planning information.

Home Super for Beginners Boost your super Comparing super funds SMSFs Retirement Super and tax. Borrowing to invest can be the means, not the end May 31, by Trish Power 3 Comments As a property and share investor for nearly 30 years, I believe the use of borrowing can be a legitimate means to purchase assets, but gearing is not an investment in itself: Share this article Facebook Email Print.

Related sections SMSFs Self-managed super funds THE SOAPBOX Related topics Financial System Inquiry FSI Investment strategies for superannuation funds Property and superannuation SMSF borrowing gearing SMSF compliance SMSF investment Super books by Trish Power Types of investments for superannuation. Comments William Crane says January 30, at Hi Trish, I totally agree with your comments — limited recourse borrowings should only be used as a tool to leverage conservatively an already high quality investment.

The same rules apply to geared property investment with a SMSF than non-SMSF property investments: More than likely if the matrimonial home has no mortgage attached The banks have effectively sidestepped the prudential intentions in the Act. Leave a Comment Cancel reply Your email address will not be published.

BlueChipPennyStocks - The number one trusted financial newsletter site

Popular superannuation topics Accessing super Age Pension rates Best performing super funds How does the Age Pension work? How much super do I need? Is my super fund performing? Making super contributions Superannuation for Beginners Superannuation Guarantee SG Taking a super pension Top 10 Super Lists Women and superannuation 10 ways to save your super 10 more ways to boost your super Federal Budget.

View all superannuation topics. Age-based superannuation guides Super Guide for under 18s Super Guide for your 20s, 30s and 40s Super Guide for your 50s Super Guide for your 60s Super Guide for 70s and over.

Learn how to use SuperGuide. Learn more about SuperGuide Contact us. Disclaimer All information on SuperGuide. Before using this website Terms and Conditions of Use Privacy Policy and Privacy Collection Statement Copyright Policy Disclaimer.

Further information Advertise on SuperGuide Superannuation and retirement planning books by Trish Power Superannuation Glossary Superannuation Newsletter Superannuation Questions Super Funds Guide What people say about SuperGuide Sitemap.

Send to Email Address Your Name Your Email Address jQuery document. SuperGuide does not provide financial advice.

SuperGuide does not answer all questions posted in the comments section. SuperGuide may use your question or comment, or use questions from several readers, as the basis for an article topic that we publish on the SuperGuide website.

We will not disclose names or personal information in these articles. Comments provided by readers that may include information relating to tax, superannuation or other rules cannot be relied upon as advice. SuperGuide does not verify the information provided within comments from readers. Readers need to seek independent advice about their personal circumstances.