What is foreign exchange market intervention

JavaScript is currently disabled. This website is best viewed with JavaScript enabled, interactive content that requires JavaScript will not be available. Australia has a floating exchange rate. This page discusses the Australian dollar exchange rate within the context of the Reserve Bank of Australia's monetary policy framework and the role of the Reserve Bank in the foreign exchange market.

The exchange rate is the price of one currency expressed in terms of another currency. The two most common measures of the Australian dollar exchange rate are:. The composition of the TWI basket is determined by the relative shares of different countries in Australia's trade, with the weights reviewed annually. The current composition of the TWI is shown in Table 1.

There are many alternative exchange rate indices, which may be relevant for different purposes. For instance, rather than using the conventional TWI based on total trade weights, indices weighted by export shares or import shares separately might be more appropriate in some instances.

In other circumstances, trade weights — which only include goods and services that are actually traded — could be considered inadequate if they do not correspond to countries' shares of production that could be traded even if it is not and hence their influence on world prices. In these instances, a GDP-weighted index may be considered preferable.

It is also worth noting that movements in broad exchange rate indices like the TWI can sometimes mask important developments in individual bilateral exchange rates or in groups of bilateral rates.

For example, there has been a marked divergence in trend movements of the Australian dollar against the currencies of the G7 and against Asian currencies excluding Japan, which are the two main groups of countries in the TWI basket. FromAustralia's currency was pegged to the UK pound, before it was changed to a peg against the US dollar in For much of this period — from to the early s — Australia's exchange rate peg operated as part of a global system of pegged exchange rates, known as the Bretton Woods system.

When the Bretton Woods system broke down in the early s, the major advanced economies floated their exchange rates. However, Australia did not follow suit, in part reflecting the fact that, at that time, Australia's financial sector was relatively underdeveloped. The Australian dollar did, however, become progressively more flexible from around the mid s. The crawling peg involved regular adjustments to the level of the exchange rate, in contrast to the occasional discrete revaluations and devaluations that had occurred under the previous regimes.

The Australian dollar eventually floated infor a number of reasons. First, the fixed exchange rate regime made it difficult to control the money supply.

However, under the fixed and crawling peg arrangements, the Reserve Bank was required to meet all requests to exchange foreign currency for Australian dollars, or vice versa, at the prevailing exchange rate. This meant that the supply of Australian dollars and therefore the domestic money supply was affected by changes in the demand for purchases and sales of Australian dollars, which could arise from Australia's international trade and capital flows.

While the Reserve Bank could seek to offset these effects through a process called sterilisationin practice, this was often difficult to achieve. Floating the exchange rate addressed this problem. It meant that one of the final prerequisites for effective domestic monetary policy had been achieved the other, namely that the government fully finance any budget deficit in the market at market interest rates, had been achieved in the early s when the Australian Government adopted a tender system for issuing bonds.

While the ability to gain greater control of domestic monetary conditions was well understood at the time as one of the key benefits of floating the exchange rate, the decision to float in late occurred largely as a result of speculative pressure on the exchange rate.

That is, in the lead-up to the float, there were very large capital inflows coming into Australia from speculators betting on an appreciation of the Australian dollar.

This was not sustainable and the government had the choice of either tightening capital controls or floating the exchange rate. The latter was chosen as the more desirable course of action. Consistent with obtaining better control over domestic monetary conditions, the choice of exchange rate regime can also influence the way in which economies cope with external shocks.

Take for example, a sharp rise in the terms of trade the ratio of export prices to import pricesas experienced in Australia's recent mining boom. The combination of a flexible exchange rate and independent monetary policy led to a high exchange rate and high interest rates relative to the rest of the world during that period, both of which played an important role in preserving overall macroeconomic stability.

This is in contrast to previous resources booms, which typically ended with an episode of significant inflation. In summary, the floating exchange rate regime that has been in place since is widely accepted as having been beneficial for Australia. The floating exchange rate has provided a buffer against external shocks — particularly shifts in the terms of trade — allowing the economy to absorb them without generating the large inflationary or deflationary pressures that tended to result under the previous fixed exchange rate regimes.

While discretionary changes were made to the value of the Australian dollar under previous regimes in response to developing pressures, it was extremely difficult to calibrate the adjustments to provide an effective buffer against the shocks.

The shift to a floating exchange rate has therefore contributed to a reduction in output volatility over the past two decades or so. Importantly, it has also enabled the Reserve Bank to set monetary policy that is best suited to domestic conditions rather than needing to meet a certain target level for the exchange rate.

One important determinant of a country's trade-weighted exchange rate over the long run is whether it has a higher or lower inflation rate than its trading partners. The theory of purchasing power parity PPP suggests that the exchange rate between two countries will adjust to ensure that purchasing power is equalised in both countries.

If a country's inflation rate is persistently higher than that of its trading partners, its trade-weighted exchange rate will tend to depreciate to prevent a progressive loss of competitiveness over time.

Graph 5 demonstrates this by showing the relationship between the nominal Australian dollar TWI and the ratio of the Australian consumer price index CPI to the average price level of Australia's trading partners. From the mid s through to the end of the s, prices in Australia rose more quickly than prices overseas. The TWI depreciated over the same period, but a large part of this was doing no more than offsetting the cumulatively higher inflation Australia was experiencing. In other words, much of what appears to have been a potential gain in competitiveness due to the lower exchange rate was offset by Australia's relatively poor performance on inflation.

Estimates of real exchange rates adjust for this difference in inflation rates. While still subject to considerable fluctuations, movements in real exchange rates provide a better guide to changes in competitiveness than movements in nominal exchange rates.

A pure purchasing power parity theory is limited to the extent that it does not capture structural factors affecting the economy, which have arguably been important in Australia's case over the past decade or so. In recognition typing work from home in karachi this, one extension of the pure purchasing power parity theory is the Balassa-Samuelson model, which predicts that countries which experience relatively rapid productivity growth in their tradable sectors will experience real exchange rate appreciation and vice versa.

While cross-country productivity differentials may have explained part of Australia's real exchange rate depreciation in the mid to late s, they are less able to explain the appreciation of the Australian dollar over the past decade or so. Historically, one of the strongest influences on the Australian dollar has been the terms of trade. For example, a rise in the terms of trade as a result of an increase in the prices of commodities which are an important component of Australia's exports provides an expansionary 409a stock option exchange to the economy through an increase in income.

The increased demand for inputs from the export sector also creates inflationary pressure. An appreciation of the exchange rate, together with higher domestic interest rates, will counteract these influences to some extent, thereby contributing to overall macroeconomic stability.

In the first 15 years of the floating exchange rate, the relationship was on average one-for-one, but it has since weakened. Nevertheless, changes in the terms of trade still play a dominant role in explaining changes in Australia's real exchange rate.

Factors that affect capital transactions are a third major influence on the exchange rate, although their importance has tended to vary over time. These factors include relative rates of return on Australian dollar assets, changes in the relative risk premium associated with investing in Australian dollar assets, and more broadly, changes in investors' appetite what is foreign exchange market intervention options futures and other derivatives 8th ppt on risk.

Anecdotally, there have been a number of periods since the float when relative rates of return were seen as being a major influence. One such episode occurred in the late s, when Australian real interest rates were much higher than those overseas and the 15 min binary option strategy 101 rate rose sharply.

The second was in the late s, when Australian real interest rates fell below those in the US and the exchange rate depreciated. The third was in the first half of the s, when Australian real interest rates were again notably higher than those in the major economies, as the major economies experienced a downturn and monetary policy was eased in these countries.

Since midrelatively high real interest rates in Australia compared with the major economies are again likely to have influenced the Australian dollar, although that effect has waned in recent years. Historically, Australian interest rates have generally been higher than those in the major economies, in part because Australian dollar assets have tended navara forex money brokers ltd embody a higher risk premium.

Changes in the size of the relative risk premium can influence the relative demand for Australian dollar assets and therefore also have a direct effect on the exchange rate. For example, the relative risk premium declined during the European debt crisis, which saw foreign demand for highly rated Australian government debt increase.

This was reflected in strong capital inflows to the Australian public sector in andwhich are likely to have provided some support to the Australian dollar though these inflows were somewhat offset by outflows from the private sector over this period, Graph 7. While it is widely accepted that attempts to forecast exchange rates are fraught with difficulty, even attempts to model historical movements in exchange rates have met with mixed success.

However, compared with some other currencies, efforts to model the Australian dollar exchange rate in the post-float era have been relatively successful in explaining medium-term movements in the currency, reflecting its strong correlation with profitable strategies and signals for binary options terms of trade.

While it is possible to identify a number of determinants of the exchange rate, it is important to note that their impact can vary over time. In particular, while the terms of trade have displayed a strong correlation with the exchange rate in the post-float era, there is evidence to suggest that this relationship has weakened over the past 15 years as discussed above.

This relationship was particularly weak in the late s and early s, when Australia's terms of trade what is foreign exchange market intervention rising but the nominal and real exchange rates both declined substantially.

Variables other than the terms of trade have sometimes helped to explain movements in the Australian dollar exchange rate. At times, real interest rate differentials have had an important role; at other times, the stock of foreign liabilities, the current account balance or economic growth differentials have been found to have an influence. In part, the changing influence of some of these variables reflects the varying focus of financial market participants.

Currency intervention - Wikipedia

The exchange rate plays an important part in considerations of monetary policy in all countries. However, the exchange rate has not served as a target or an instrument of monetary policy in Australia since the s — instead, it is best viewed as part of the transmission mechanism for monetary policy.

Money exchange rates kenya generally, the exchange rate serves to buffer the economy from external shocks, such that monetary policy can be directed towards achieving domestic price stability and growth.

Since the early s, Australian monetary policy has been conducted under an inflation targeting framework.

Guidelines for Foreign Exchange Reserve Management

Under inflation targeting, monetary policy no longer targets any particular level of the exchange rate. Various measures suggest that exchange rate volatility has been higher in the post-float period Graph 4, above. However, exchange rate flexibility, together with a number of other economic reforms — including in product and labour markets as well as reforms to the policy frameworks for both fiscal and monetary policy — has likely contributed to a decline in output volatility over this period.

In particular, exchange rate do commodity brokers make money have played a particularly important role in smoothing the influence of terms of trade shocks. Similar findings have been made option trading tfsa other commodity producing countries.

Both through counterbalancing the influence of external shocks, standard bank stockbrokers jersey more directly, through its influence on domestic incomes and therefore demand, the exchange rate has been an important influence on inflation. However, the floating of the exchange rate meant that changes in world prices no longer had a direct effect on domestic prices: The extent of this influence has changed since the float, and since the introduction of inflation targeting.

In particular, exchange rate pass-through has become more protracted in aggregate, but is faster and larger for manufactured goods, which are often imported. The observed slowdown in aggregate exchange rate pass-through is not unique to Australia, having been also found in the United Kingdom and the United States, among others.

According to the most recent global survey of foreign exchange markets conducted by the Bank for International Settlements in April the Australian market is the eighth largest in the world, although the two largest — the United Kingdom and the United States — are much larger than the remainder.

The remaining half is largely made up of trade in major currencies against the US dollar, although trade in less traditional currencies has continued to expand.

What is Foreign Exchange? definition and meaning

Between andturnover in the Australian and nifty futures what time do trading start tips markets grew rapidly, supported by increased cross-border investment and trade flows.

Following the onset of the global financial crisis, foreign exchange turnover fell in both Australia and in other major markets, driven initially by a decline in foreign exchange FX swaps turnover, which was in turn related to reduced cross-border investment activity FX swaps are transactions in which parties agree to exchange two currencies on a specific date and to reverse the exchange at a later date, and are commonly used to hedge foreign exchange exposures arising from cross-border claims, Graph 9.

Subsequently, the collapse in international trade in late also saw turnover in the spot market fall sharply. While between and earlyforeign exchange turnover in the Australian market recovered in line with global markets, it dipped again in late amid heightened market uncertainty related to the European sovereign debt crisis.

Sinceforeign exchange turnover in Australia has remained relatively stable. Foreign exchange derivatives, including both traditional and non-traditional products, are an important tool for many Australian companies with foreign currency exposures, because they can be used to provide protection against adverse exchange rate movements.

As well as trading in Australia, there is considerable turnover of the Australian dollar in other markets. The size of the market indicates that the exchange rate is being determined in a liquid, active and competitive marketplace.

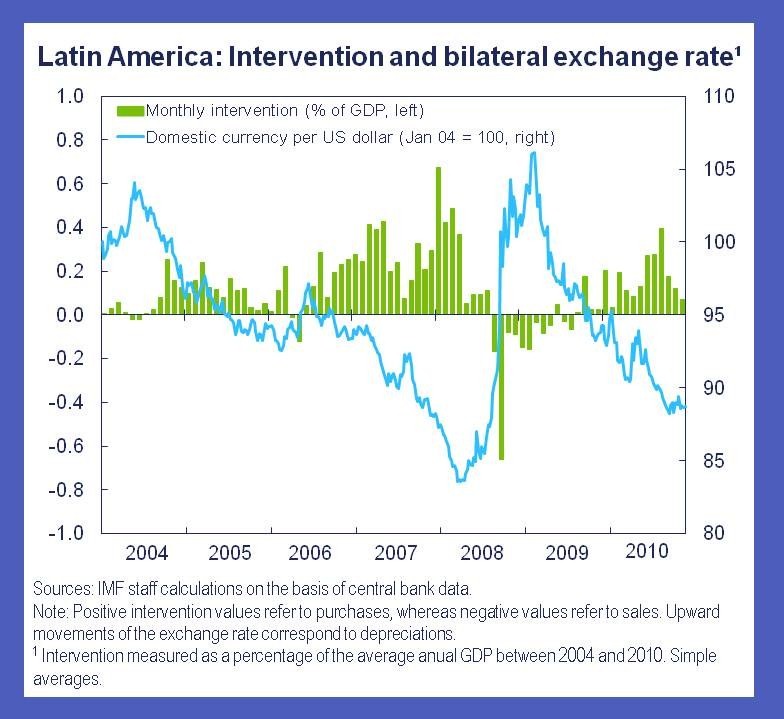

The Bank's approach to foreign exchange market intervention has evolved over the past 30 years as the Australian foreign exchange market has matured. In particular, intervention has become less frequent, as awareness of the benefits of a freely floating exchange rate has grown. These benefits rely in part upon market participants and end-users being able to effectively manage their exchange rate risk, a process requiring access to well-developed foreign exchange markets.

In the period immediately following the float, the market was at an early stage of development and the exchange rate was relatively volatile as a result.

As market participants were not always well-equipped to cope with this volatility, the Bank sought to mitigate some of this volatility to lessen its effect on the economy.

But even before the end of the s, the foreign exchange market had developed significantly, and the need to moderate day-to-day volatility was much diminished.

More recently, intervention has been in response to episodes that could be characterised by evidence of significant market disorder — that is, instances where market functioning has been impaired to such a degree that it was clear that the observed volatility was excessive — although the Bank continues to retain the discretion to intervene to address gross misalignment of the exchange rate.

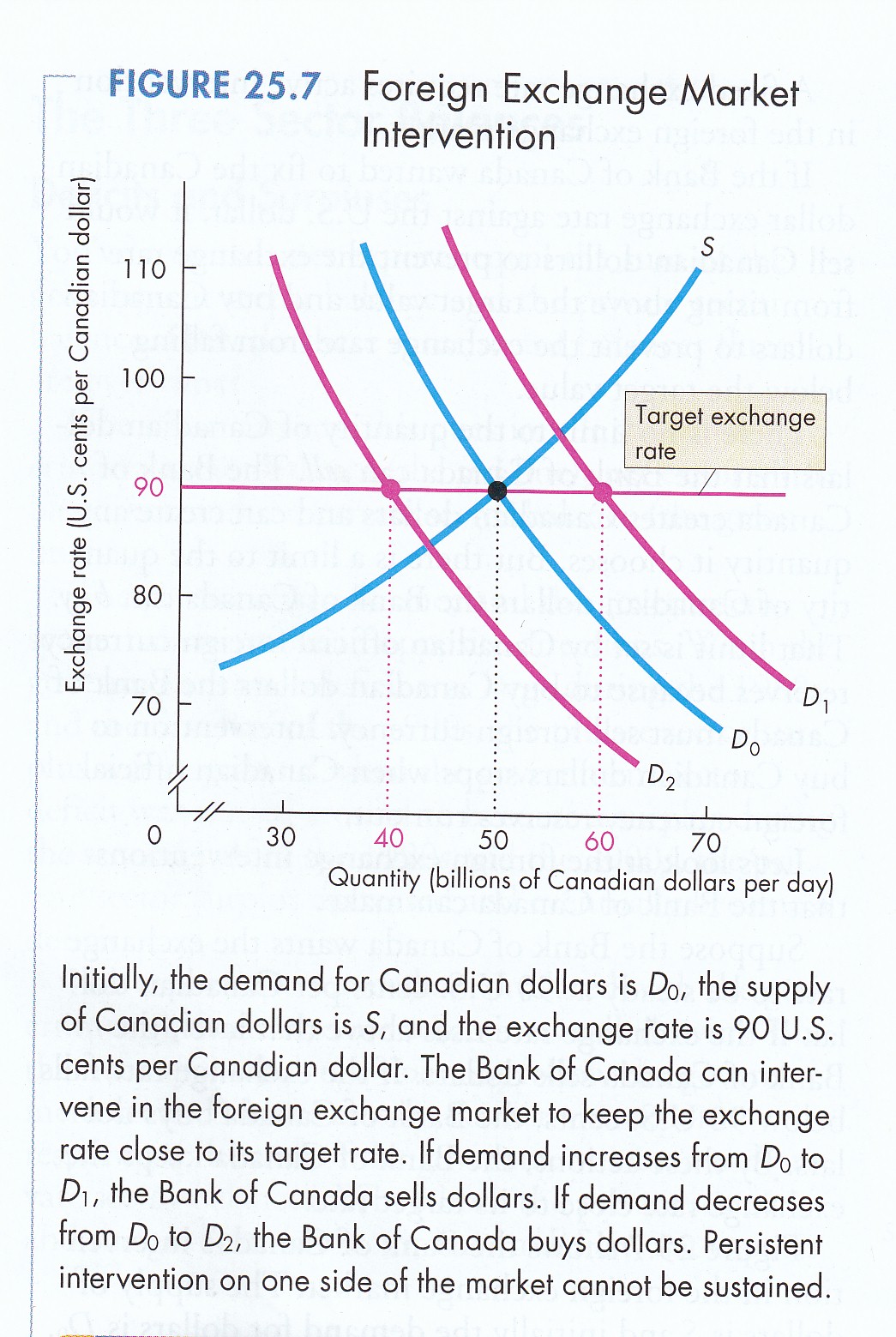

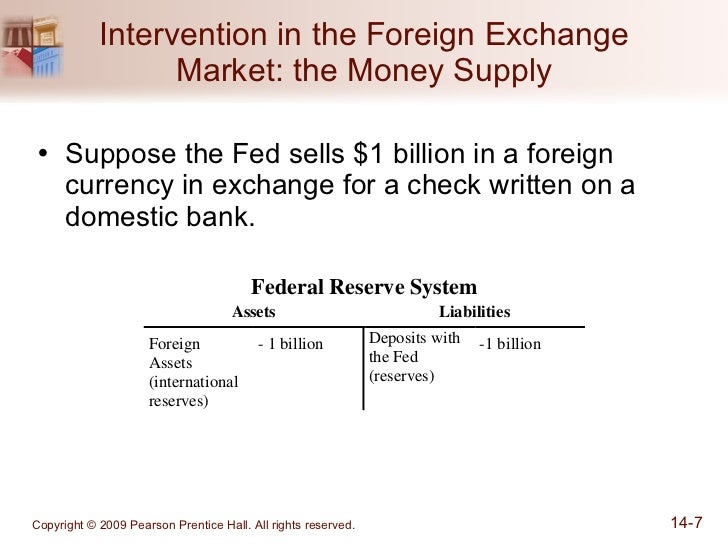

Accordingly, on each of these occasions, the Reserve Bank's interventions were designed to improve liquidity in the market and thereby limit disruptive price adjustments. When the Reserve Bank intervenes in the foreign exchange market, it creates demand or supply for the Australian dollar by buying or selling Australian dollars against another currency.

The Reserve Bank has the capacity to deal in foreign exchange markets around the world and in all time zones. The Reserve Bank's foreign exchange intervention transactions to date have been executed almost exclusively in the spot market.

In large part, the approach taken by the Bank will depend on the precise objective of the intervention and, in particular, the type of signal the Bank wishes to send to the market. By using its discretion in deciding when to transact, the size of the transaction and how the transaction will be conducted, the Reserve Bank is potentially able to elicit different responses from the foreign exchange market. Generally speaking, transactions that are relatively large in size and signalled clearly are expected to have the largest effect on market conditions, with these effects further amplified if trading conditions are relatively illiquid.

This is in stark contrast to the routine foreign exchange transactions undertaken by the RBA on behalf of the Government, where the express intention is to have a minimal influence on the exchange rate. Historically, the Reserve Bank has generally chosen to intervene by transacting in the foreign exchange market in its own name, in order to inform participants of its presence in the market. The intervention transactions are typically executed through the electronic broker market, or through direct deals with banks.

The effects of direct transactions with banks are realised over two stages. First, after receiving a direct quote request from the Reserve Bank, banks will adjust their quotes as compensation for holding the currency the Reserve Bank is trying to sell and for bearing the potential risk that the Reserve Bank is simultaneously dealing with other banks who would also be adjusting their quotes.

For example, if the Reserve Bank wants to sell US dollars and purchase Australian dollars, banks will increase their Australian dollar offer quotes. Second, after banks have traded with the Reserve Bank, this can trigger additional price adjustments among market makers in the spot foreign exchange market. It is inherently difficult to quantify the effect of intervention transactions on the exchange rate for at least three key reasons:.

These difficulties have led to the development of a number of different methods of attempting to evaluate the effectiveness of intervention, three of which have been employed by Reserve Bank staff in recent years to evaluate the effectiveness of Reserve Bank intervention.

The first Kearns and Rigobon,used the change in the Reserve Bank's intervention policy in the early s when the Bank ceased to make very small interventions to identify the contemporaneous relationship between intervention and the exchange rate. Intervention was found to have a significant effect on the exchange rate, particularly on the day of intervention.

The application of the profits test relies on the central bank acting as a stabilising long-term speculator.

If the objective of the central bank is to limit fluctuations in the exchange rate, this will tend to involve the purchase of the local currency sale of foreign currency when the exchange rate is relatively low, and the sale of the local currency purchase of foreign currency when the exchange rate is high. It follows from this that if a central bank has been profitable in its intervention, it must have bought low and sold high, therefore contributing to the stabilisation of the exchange rate.

These studies both found that the Reserve Bank's intervention activities have been profitable, and therefore, stabilising. The third study Newman, Potter and Wright, presented the results of time series econometrics using a unique dataset that specifically addressed problem iii above.

Notwithstanding the improved dataset, the results of this paper mainly demonstrated the difficulties in drawing strong conclusions about the effectiveness of interventions from time series analysis, owing to some inherent limitations — in particular, problems i and ii above.

Nevertheless, this study does find some weak evidence that the Reserve Bank's interventions have been effective. Skip to content JavaScript is currently disabled. Reserve Bank of Australia Open menu Close menu. Search RBA website Search. In Market Operations About Market Operations Domestic Market Operations International Market Operations Resources Technical Notes for Domestic Market Operations Eligible Counterparties Eligible Securities Margin Ratios Valuing Asset-Backed Securities Without Observed Market Prices Settlement Procedures Open Market Operations Standing Facilities CLF Terms and Conditions CLF Operational Notes AOFM Securities Lending Facility Margin Maintenance and Substitutions on Repurchase Agreements Pricing Formulae for Australian Government Securities Cash Rate methodology Overview Cash Rate Procedures Manual Compliance with IOSCO Principles Media Releases Speeches Publications Statistics Securitisations Industry Forum.

The Exchange Rate and the Reserve Bank's Role in the Foreign Exchange Market. Copyright Disclaimer Judicial Notice Privacy Accessibility Scams PID Access to Information Follow us: Twitter RSS Webcasts E-mail service YouTube LinkedIn Flickr. Banknotes Museum CFR AFXC Foundation for Children.