409a stock option exchange

January 19, By Yokum 19 Comments. On April 10,the Internal Revenue Service IRS issued final regulations under Section A of the Internal Revenue Code. Section A was added to the Internal Revenue Code in October by the American Jobs Creation Act. Under Section A, unless certain requirements are satisfied, amounts deferred under a nonqualified deferred compensation plan as defined in the regulations currently are includible in gross income unless such amounts are subject to a substantial risk of forfeiture.

In addition, such deferred amounts are subject to an additional 20 percent federal income tax, interest, and penalties. Certain states also have adopted similar tax provisions. For example, California imposes an additional 20 percent state tax, interest, and penalties.

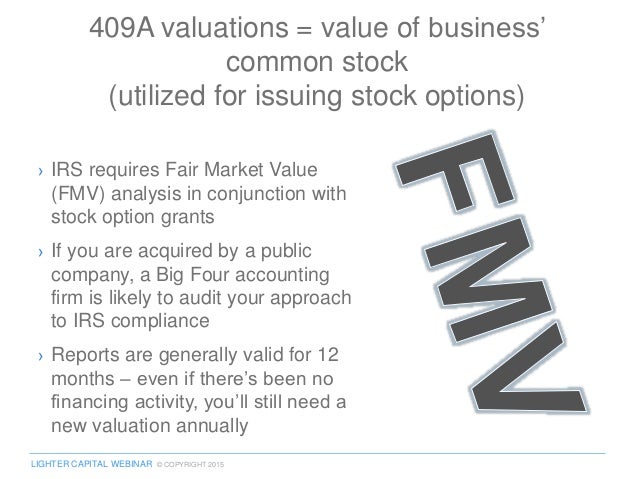

Under Section A, a stock option having an exercise price less than the fair market value of the common stock determined as of the option grant date constitutes a deferred compensation arrangement. This typically will result in adverse tax consequences for the option recipient and a tax withholding responsibility for the company.

The company is required to withhold applicable income and employment taxes at the time of option vesting, and possibly additional amounts as the underlying stock value increases over time.

Highlights of the Final Section A Regulations published April 16, Stock Rights Under Final Section A Regulations April 19, Separation Pay Arrangements under the Final Section A Regulations April 27, A Road Map for Traditional Nonqualified Deferred Compensation Plans under the Final Section A Regulations May 17, Action Items for Compliance with Section A Final Regulations June 12, IRS Provides Transition Relief until December 31,for Section A Compliance October 24, Compliance Required with Section A before December 31, June 12, We are struggling with this right now with.

We want to properly motivate our people currently contractorsbut we worry that too low of a strike price might signal low valuation to a future investor. Yokum, Suppose deferred compensation comes in the form of convertible notes, convertible into a series B preferred stock to be issued.

Does the fact that, until the series B closes, the risk of forfeiture is very high put the compensation outside the realm of A? If the notes are converted to the series B preferred, does the fact that the compensation is no longer a legal obligation to pay put the deferral outside the realm of A?

If the person receives the convertible note for free, then it strikes me that there probably is a taxable event at that point in time. In a cash sale of a private company, what is the typical disposition of unvested options?

Ijm — If the options are not assumed by the acquiror, unvested options fully vest and the option holder can either exercise and receive merger proceeds or receive net cash equal to the price per share to the common minus the exercise price colombo stock exchange market watch share.

Is A Valuation is MUST do item for a start-up? Or does the Board of Directors have the right to wave that requirement and take the risk? If the company has received venture financing or has revenues, then I think it is a must do item from a risk perspective.

The A valuation report shifts the burden of proof to the IRS to show that the exercise price was wrong.

However, the company should prepare a valuation analysis on fair market value of the common stock to support the board conclusion on fair market value. Yokum, Our startup is struggling with the strike price on our first grants of options under our employee stock incentive plan.

Do you have any tips on a valuation analysis my board could use? We are pre-revenue, so any process at this point 409a stock option exchange arbitrary.

Burt — if the company did a Series A stock options silk shirts institutional venture capital investors, then the company should get a A valuation. Of course, any rules of thumb like this are not proper accounting.

The note is only convertible into class B preferred shares…no cash.

The note was given in lieu of cash compensation. The company is pre-revenue and needs to raise funds thru the class B offering. Until the B actually closes there is a high probability of bankruptcy and default. Does the fact that the company does not have to pay cash to redeem the note put the deferred comp. I would appreciate your advice on how to handle the situation of the A valuation being lower than the FASR valuation.

Please read the disclaimers. I have heard of many situations where the auditors are rejecting A valuations.

At the end of the day, I think that the company needs to appease the auditors with an acceptable 1 ranked binary options brokers comparison brokerage R valuation for accounting purposes, but that does not necessarily create an issue with the IRS as long as a A-compliant valuation backs up the option exercise price.

Companies used to take cheap stock charges in connection with IPOs, which tacitly admits that the option price was too low. However, as far as I know, the IRS has not taken the position that these option grants with exercise prices that were too low are no longer ISOs which need to be granted at FMV.

When a consultant or a law firm agrees to work in exchange for options in a client, how do you determine the number of options you receive as a fee?

Internal Revenue Bulletin - May 7, - T.D.

Any good option agreements online? Bill Mc — There are probably a few different ways to think about it. One is to simply express the number of shares as a percentage of the company. Make money through adfly way to think about it is in terms of value provided somewhat like warrant coverage.

Perhaps even a different way to benchmark the size of option grant is to look at assumed in the money value and grant enough shares to provide the implied value.

Options That Fail A? It's Easy To Do. - Part I | Tax Law for the Closely Held Business

For most companies, there will be a difference between preferred stock FMV and common FMV. Generally, consultant options will be exercisable for a period between 5 and 10 years.

They might be fully-vested upon grant upon completion of services and not dependent on continuous status as a service provider in order to be exercised.

The Importance of 409A and Equity Awards for Growing CompaniesHowever, some may be subject to continued services in order to be exercisable. An option grant is not a do it yourself exercise. There are various things that can be screwed up ranging from A compliance, securities law issues, failure to obtain valid approvals which may result in option backdating, etc. How much does implementing an employee stock option plan typically cost the company legal fees, admin.

My company has three principals and five employees and we'd like to being offering equity incentives to key employees. It doesn't seem like it should be that complicated. Basically, I'm trying to figure out whether or not I'm getting ripped off. Even if you incorporated DIY online and someone had to redo every doc, it would still be less that that range to redo everything and have a company with a stock option plan. Well, the A valuation issue is not going away. I believe the IRS has started scrutinizing the first of these arrangements.

I believe there are quality appraisers out there including us who provide supportable, defendable and qualified A valuations. There are also companies that cannot be considered completely independent valuation experts as they provide other services such as CFO rental or banking to the same clients they value.

The IRS is bound to hold such arrangements as non-independent. The keywords in choosing a A provider ought to be: Due diligence and application of reasonable standards are what audit firms are looking for, and the IRS will look for. With outsourced talent and very cheap valuations, we find these two elements totally lacking. Index About Yokum Disclaimer Privacy Policy Contact Yokum FAQs. Background On April 10,the Internal Revenue Service IRS issued final regulations under Section A of the Internal Revenue Code.

Implications for discount stock options Under Section A, a stock option having an exercise price less than the fair market value of the common stock determined as of the option grant date constitutes a deferred compensation arrangement.

Yokum, In a cash sale of a private company, what is the typical disposition of unvested options? Hi Yokum, When a consultant or a law firm agrees to work in exchange for options in a client, how do you determine the number of options you receive as a fee?

Hi Yokum — How much does implementing an employee stock option plan typically cost the company legal fees, admin. Thanks for any advice you can lend.