Stock market anomalies calendar effect

In the non-investing world, an anomaly is a strange or unusual occurrence. In financial markets , anomalies refer to situations when a security or group of securities performs contrary to the notion of efficient markets , where security prices are said to reflect all available information at any point in time.

Calendar Effects

With the constant release and rapid dissemination of new information, sometimes efficient markets are hard to achieve and even more difficult to maintain. There are many market anomalies; some occur once and disappear, while others are continuously observed.

To learn more about efficient markets, see What Is Market Efficiency? Can anyone profit from such strange behavior? We'll look at some popular recurring anomalies and examine whether any attempt to exploit them could be worthwhile. Calendar Effects Anomalies that are linked to a particular time are called calendar effects. Some of the most popular calendar effects include the weekend effect , the turn-of-the-month effect, the turn-of-the-year effect and the January effect.

Why Do Calendar Effects Occur? So, what's with Mondays?

Why are turning days better than any other days? It has been jokingly suggested that people are happier heading into the weekend and not so happy heading back to work on Mondays, but there is no universally accepted reason for the negative returns on Mondays. Unfortunately, this is the case for many calendar anomalies. The January effect may have the most valid explanation. It is often attributed to the turn of the tax calendar; investors sell off stocks at year's end to cash in gains and sell losing stocks to offset their gains for tax purposes.

Once the New Year begins, there is a rush back into the market and particularly into small-cap stocks. Announcements and Anomalies Not all anomalies are related to the time of week, month or year. Some are linked to the announcement of information regarding stock splits, earnings, and mergers and acquisitions. As such, stock splits are often viewed by investors as a signal that the company's stock will continue to rise. Empirical evidence suggests that the signal is correct. For related reading, see Understanding Stock Splits.

Superstitious Indicators Aside from anomalies, there are some nonmarket signals that some people believe will accurately indicate the direction of the market. Here is a short list of superstitious market indicators: Why Do Anomalies Persist? These effects are called anomalies for a reason: No one knows exactly why anomalies happen.

People have offered several different opinions, but many of the anomalies have no conclusive explanations. There seems to be a chicken-or-the-egg scenario with them too - which came first is highly debatable. Profiting From Anomalies It is highly unlikely that anyone could consistently profit from exploiting anomalies. The first problem lies in the need for history to repeat itself. Second, even if the anomalies recurred like clockwork, once trading costs and taxes are taken into account, profits could dwindle or disappear.

Finally, any returns will have to be risk-adjusted to determine whether trading on the anomaly allowed an investor to beat the market. To learn much more about efficient markets, read Working Through The Efficient Market Hypothesis. Conclusion Anomalies reflect inefficiency within markets.

Some anomalies occur once and disappear, while others occur repeatedly. History is no predictor of future performance, so you should not expect every Monday to be disastrous and every January to be great, but there also will be days that will "prove" these anomalies true! Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Making Sense Of Market Anomalies By Tisa Silver Share.

The weekend effect describes the tendency of stock prices to decrease on Mondays, meaning that closing prices on Monday are lower than closing prices on the previous Friday. For some unknown reason, returns on Mondays have been consistently lower than every other day of the week.

In fact, Monday is the only weekday with a negative average rate of return. Years Monday Tuesday Wednesday Thursday Friday Fundamentals of Investments , McGraw Hill, Turn-of-the-Month Effect: The turn-of-the-month effect refers to the tendency of stock prices to rise on the last trading day of the month and the first three trading days of the next month. Years Turn of the Month Rest of Days 0.

Fundamentals of Investments , McGraw Hill, Turn-of-the-Year Effect: The turn-of-the-year effect describes a pattern of increased trading volume and higher stock prices in the last week of December and the first two weeks of January.

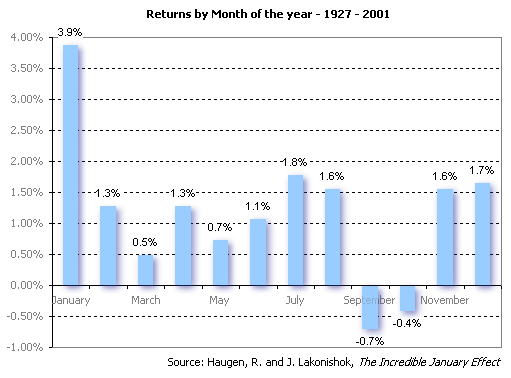

Years Turn of the Year Rest of Days 0. Fundamentals of Investments , McGraw Hill, January Effect: Amid the turn-of-the-year market optimism, there is one class of securities that consistently outperforms the rest. Small-company stocks outperform the market and other asset classes during the first two to three weeks of January.

This phenomenon is referred to as the January effect. Keep reading about this effect in January Effect Revives Battered Stocks. Occasionally, the turn-of-the-year effect and the January effect may be addressed as the same trend, because much of the January effect can be attributed to the returns of small-company stocks. Stock splits increase the number of shares outstanding and decrease the value of each outstanding share, with a net effect of zero on the company's market capitalization.

However, before and after a company announces a stock split, the stock price normally rises. The increase in price is known as the stock split effect. M any companies issue stock splits when their stock has risen to a price that may be too expensive for the average investor. After announcements, stock prices react and often continue to move in the same direction. For example, if a positive earnings surprise is announced, the stock price may immediately move higher.

Short-term price drift occurs when stock price movements related to the announcement continue long after the announcement. Short-term price drift occurs because information may not be immediately reflected in the stock's price. When companies announce a merger or acquisition, the value of the company being acquired tends to rise while the value of the bidding firm tends to fall.

Merger arbitrage plays on potential mispricing after the announcement of a merger or acquisition. The bid submitted for an acquisition may not be an accurate reflection of the target firm 's intrinsic value ; this represents the market anomaly that arbitrageurs aim to exploit.

Arbitrageurs aim to take advantage of the pattern that bidders usually offer premium rates to purchase target firms. The Super Bowl Indicator: When a team from the old American Football League wins the game, the market will close lower for the year.

When an old National Football League team wins, the market will end the year higher. However, the indicator has one limitation: It contains no allowance for an expansion-team victory. The market rises and falls with the length of skirts. Sometimes this indicator is referred to as the "bare knees, bull market " theory. To its merit, the hemline indicator was accurate in , when designers switched from miniskirts to floor-length skirts just before the market crashed.

A similar change also took place in , but many argue as to which came first, the crash or the hemline shifts. Stock prices and aspirin production are inversely related. This indicator suggests that when the market is rising, fewer people need aspirin to heal market-induced headaches. Lower aspirin sales should indicate a rising market. See more superstitious anomalies at World's Wackiest Stock Indicators.

Calendar Effect

Certain tradable anomalies persist in the stock market. Here are six that fascinate investors. We explain what they are, the thinking behind them as well as their results.

What about best month? Here's how time affects trading decisions based on daily, weekly and monthly trends. Be a savvy investor - learn how corporate actions affect you as a shareholder. Warren Buffett's Berkshire Hathaway recently split its stock. Is this a sign to buy? Find out why a stock with a six-figure share price can still be a good value. Since stock splits decrease the stock price, do they also increase volatility because shares are traded in smaller increments?

Investopedia examines assumptions about this increasingly common Most trades, including short sales and options, aren't materially affected by a stock split. Still, it's important for shareholders to understand how these events impact various aspects of investing.

The efficient market hypothesis EMH suggests that stock prices fully reflect all available information in the market. This high-risk strategy attempts to profit from price discrepancies that arise during acquisitions. Learn what the price effect is and how it is related to consumer spending.

Stock Market Anomalies: A Survey of Calendar Effect in BSE-SENSEX by Abhijeet Chandra :: SSRN

Learn what two components make up the price effect Find out what happens to the value of a mutual fund when a stock in its portfolio splits, including how stock splits work Learn what a stock split is, how it is accounted for and where to find upcoming information about stock splits on the Internet. Read about the reasons why market actors identify the effective interest rate as it pertains to investing, lending and accounting.

An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

What is MARKET ANOMALY? What does MARKET ANOMALY mean? MARKET ANOMALY meaning & explanation