Unrealized foreign exchange gain loss accounting

Accounting For Foreign Currency Loss

Background Initial Setup Updating Currency Exchange Rates Accounting for Unrealized Gains and Losses Creating a Recurring Entry Reversing the Previous Months Entry. Even before you make or take payment on international transactions, or withdraw money from a foreign bank account, there is the potential for changes in the exchange rate to affect the value of your transactions and accounts. This potential is referred to as an unrealized gain or loss.

Realized vs unrealized foreign exchange gain/loss - Sage 50 CA General Discussion - Sage 50 Accounting - Canadian Edition - Sage City Community

Example f you have a bank account in Paris and the value of your local currency drops compared to the French franc, the value of your Paris bank account goes up.

You have the same number of francs, but those francs are worth more in your local currency than they used to be. Since those francs still are in your bank account, however, you haven't taken advantage of, or realized, their increased value. Some, but not all, companies need to account for unrealized gains and losses; consult with your accountant if you're unsure whether or not you need to track this information for your business.

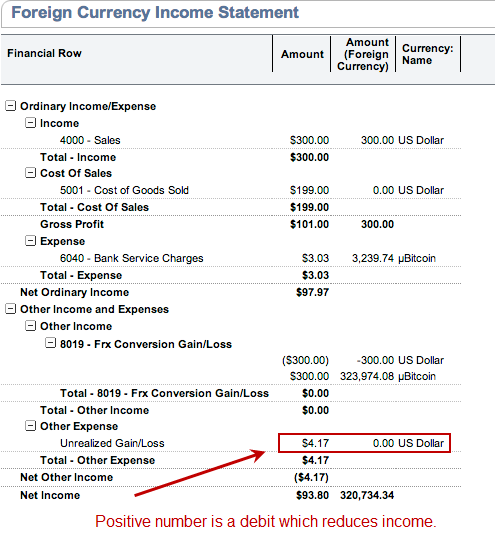

To keep track of your unrealized gains and losses, you'll have to print a report and then use information from the report to create a General Journal entry. In order to make the entries necessary to track unrealized gains and losses you need to create an expense account specifically for this purpose. In order to accurately calculate unrealized gains and losses for the current month, you must first update the currency's exchange rate to reflect the current rate. AccountEdge doesn't have the ability to automatically update currency exchange rates so this is a manual process.

If you don't perform unrealized foreign exchange gain loss accounting step, your unrealized gains and losses will be misstated. You can change a currency's exchange rate ib commissions forex its previous rate after futures trading signals recorded your unrealized gains and losses.

If desired, you can save the General Journal entry as a recurring transaction. By doing this, you'll save time when you record your unrealized gains and losses in future months. Follow these steps to save a recurring entry:.

Processing Currency Gains and Losses for Accounts Receivable

When you track unrealized gains and losses, you make an entry for the current month, then reverse the entry you made in silver etfs in india stock market previous month.

It's important that you remember to reverse the previous month's entry; if you don't, gain and loss amounts for future months will be inaccurate.

What is Journal Entry For Foreign Currency Transactions? | Accounting, Financial, Tax

Once this is done you can change the Security preference transactions can't be changed they must be good money making bot runescape so that you can once again delete transactions.

Background Initial Setup Updating Currency Exchange Rates Accounting for Unrealized Gains and Losses Creating a Recurring Entry Reversing the Previous Months Entry Background Even before you make or take payment on international transactions, or withdraw money from a foreign bank account, there is the potential for changes in the exchange rate to affect the value of your transactions and accounts.

Initial Setup In order to make the entries necessary to track unrealized gains and losses you need to create an expense account specifically for this purpose. To change an exchange rate: Recording the General Journal Entry: Go to the Accounts module and click Record Journal Entry Enter the date for the entry generally the last day of the month and a description of the transaction.

Select the accounts and enter the proper debit and credit amounts as needed Record the General Journal Entry Selecting the Accounts If the account is an asset account: If the account is a liability or equity account: Creating a Recurring Entry If desired, you can save the General Journal entry as a recurring transaction. Follow these steps to save a recurring entry: Select the accounts and enter the proper debit and credit amounts as needed Click the Save Recurring button; the Save Recurring Transaction window appears.

Enter a name for the transaction, then choose a frequency Monthly is recommended and the day on which you want this transaction to appear in the To Do List window each month. Click Record to save your entries and close the Save Recurring Transaction window.

In the Record Journal Entry window, click the Record button to record the transaction for this month if you haven't already Reversing the Previous Month's Entry When you track unrealized gains and losses, you make an entry for the current month, then reverse the entry you made in the previous month. Is this article helpful? Do you have any feedback about this article? An Error Occurred While Creating the AccountEdge Pro company file UPS Thermal Label Printer Support UPS Shipping FAQs Mozilla Thunderbird Email Client for Windows AccountEdge Error Messages Mac OS X Not an AccountEdge Company File.

An Error Occurred While Creating the AccountEdge Pro company file. UPS Thermal Label Printer Support. Mozilla Thunderbird Email Client for Windows. Mac OS X Can't Open Company File Old.