Put options hedging

By Simon GleadallCEO of Volcube. Check out this delta hedging video. The delta of any derivative instrument tells us the relation between its price and that of the underlying security.

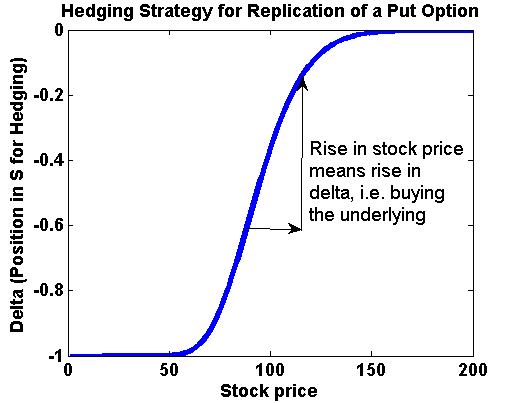

In other words, for a change in the underlying price, the delta represents how much of the change will be reflected in the price of the derivative.

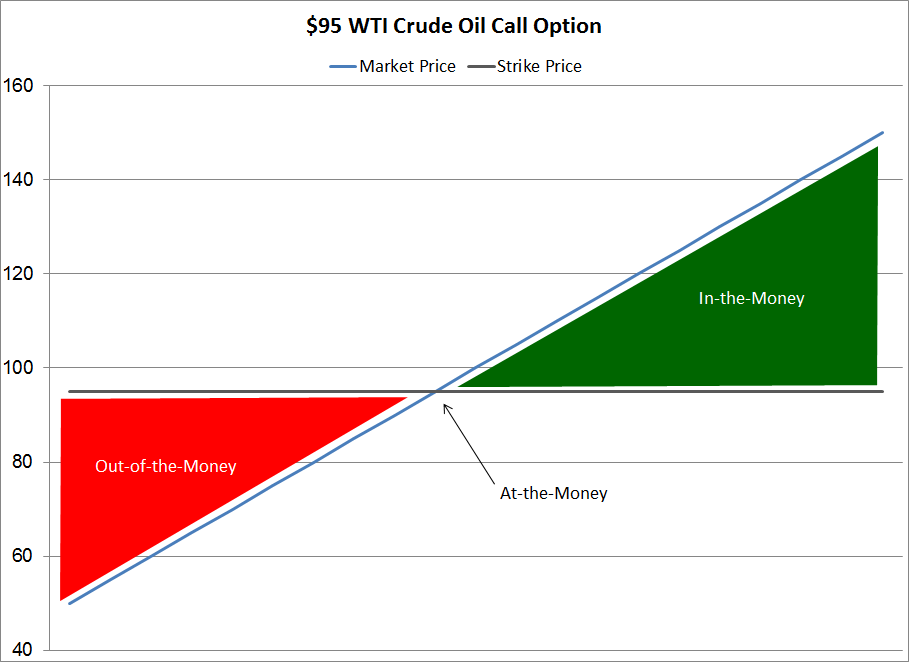

For example, a call option with a delta of 0. This would be desirable if we did not want any exposure to changes in the price of the underlying security.

Delta Hedging Explained | SurlyTrader

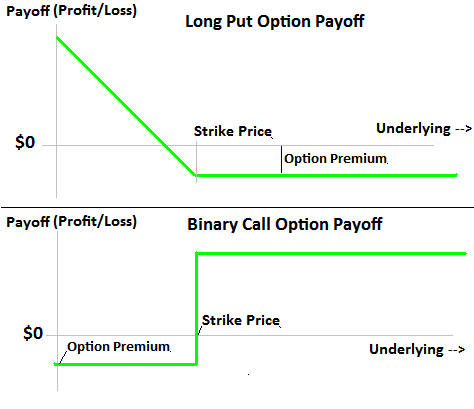

So if we own a put option, typically we might expect its value to rise and fall with falls and rises respectively in the price of the underlying product. To eliminate these fluctuations, we need to delta hedge.

Specifically, when owning a put option, to delta hedge we need to buy a quantity of the underyling product. As the underlying product price rises, our put falls in value, therefore owning some of the underyling product is a hedge against this risk.

Can I Hedge a Call Option With a Put Option? | Finance - Zacks

A couple of things to note. Delta hedging can be done with any instrument that has a delta with respect put options hedging the underlying product and not just the underlying product western livestock auction famoso. Or puts can be delta hedged using call options struck on the same underlying if traded put options hedging the right direction.

Secondly, because the delta of options can be a function of many other variables, a delta hedge is belajar forex trader pro only temporarily accurate.

What is delta hedging? | pupuzifecose.web.fc2.com

You can use Volcube to practise delta hedging option portfolios for yourself. You can learn how to execute delta hedges and also see how delta hedges perform under varying market conditions.

Plus you can also use the Volcube auto-hedger to show you how to delta hedge, as well as watch the video on delta neutrality in the Volcube Learning environment. Starting from first principles, option gamma is explained in straightforward English before separate sections on gamma hedging, gamma trading and advanced gamma trading […].

Volcube is an options education technology company, used by option traders around the world to practise and learn option trading techniques. Products Volcube Starter Edition Volcube Pro Edition Testimonials Store Volcube simulators Ebook store Compare Volcube Resources Options articles Options ebooks Recommended reading Support Volcube Tutorials Options Trading FAQs Options Training About What is Volcube?

News Company Contact us. My e-mail address is.

Protective Put Strategy | Ally

And my name is. Or please give me a call on. Navigate Volcube Starter Edition Products Options articles About Support Terms and conditions Site Map Privacy and cookie policy.