How to calculate the premium of a call option

If you're going to sell callsit's a good idea to learn how to calculate covered call returns. It's important to be able to track your trading or investing performance in order to evaluate its effectiveness. There are different ways to calculate the returns on your covered call positions because there are different scenarios.

As far as the IRS is concerned I'm writing from a United States perspectivecovered calls per se don't technically exist. By that, I mean that what you report on your tax returns are the purchases and sales of individual stock and option positions.

I'm obviously no tax accountant, so you should always consult with someone who is one for confirmation, clarification, advice, etc. But from a personal investing viewpoint, there are different ways to track the performance of your covered call strategies, based on your objectives and preferences.

Calculating the income returns your covered call position generates is pretty straightforward, although there can be variations based on where you set the strike price when writing a call.

I always calculate the potential or maximum income returns a trade will make if everything works out as expected or hoped. It's important to evaluate beforehand if the potential returns are, for you, worth both the downside and upside risks of covered calls. So how do you go about doing that?

You simply take the net premium received and divide it by the cost of your shares. And then you turn that into an annualized figure. If you're confused at all, it's probably easier to understand in formula mode. And, for our example, let's assume the holding period is for 30 days:. The cost basis on your stock includes all commissions paid to acquire the stock. Also, be sure to reduce your net premium amount by whatever commission you pay to sell the call. And be aware that if the call gets exercised i.

But it's only after the trade is completely terminated by you closing it early, by being assigned, or by the call expiring worthless that can you confirm the exact numbers and rates of return. Click here for more indepth information on calculating annualized returns and why I use this metric extensively both for option trade setups and trade management. Our first example was pretty simple because our only gains were the income gains that were generated from writing the call at the money or in the money.

But what happens when capital appreciation of the stock is also involved? Let's update the earlier example and find out.

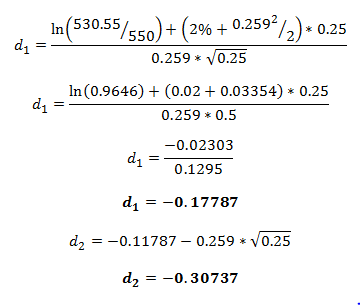

Option Premium Calculator

The formula this time around has a few more parts in it, but is still relatively easy to put together: The sum of your net premium received plus your realized capital gains all divided by the original cost basis of your stock. This is a pretty aggressive example. Although it does show that writing calls can produce sizable returns, it also shows that what can be a conservative option trading strategy can also be turned into a higher risk option trading statutory versus non statutory stock options. For more on this, see: How Risky Are Covered Calls?

Calculating gains and losses on Call and Put option transactionsOf course, you hope hawaii stock market investing never have to, but if and when you do realize a loss on your covered call positionit's important to acknowledge and track it. The key word here is realize. Just because the stock goes down, doesn't mean you've lost money.

Of course, you shouldn't hold on to a losing stock simply because you don't want to realize a loss or admit that you were wrong.

India Options FAQs >> Learn how to trade options in India >> Call Options >> Put Options

Always remember the importance of stock selection when selling calls - see the 5 criteria for finding the best stocks for covered calls for more on this topic. But let's consider an example where you were clearly wrong about the health of the underlying stock and have changed your mind and are now expecting even more downside.

In the real world, how to calculate the premium of a call option you close a covered call early, you're going to have to close the call portion as well as selling the underlying stock. If you welcome bonus no deposit forex 2016 close the short call along with the stock portion, you would end up with a naked call situation.

Realistically then, it's likely that you would be required to close the short option in order for the stock sale to be approved. And then there are commissions involved which tacks on additional costs to close the transaction.

The formulas and methods detailed above are well suited for covered call option traders looking to maximize their returns in the short term as well as for those who write calls primarily for the income stream. But if you have a longer term investing horizonand are more interested in approaches to boost your long term portfolio than maximizing gains in the short term see Investing vs Tradingthen you might consider calculating and tracking your covered call performance in terms of cost basis.

This, in fact, is very similar to how I track my own Leveraged Investing results.

Understanding Option Pricing

I call it adjusted cost basis and it basically works like this:. Instead of calculating your realized net premium income as a return, you can instead think of it as a reduction of your original cost basis.

With the adjusted cost basis method, you "adjust" your cost basis by the amount of the premium you've booked to date. Again, I need to reiterate that this is not an approved tax accounting method, but rather a personal one. If an option expires worthless, that net premium is considered - and taxed accoredingly as - a short term capital gain. I love the concept of an adjusted cost basis.

How to Calculate an Option Premium | The Finance Base

I also incorporate it when calculating dividend yield on my long term Leveraged Investments. I've referred to this elsewhere as Buy and Hold and Cheat. Return from Calculate Covered Call Returns to Covered Calls. Return from Calculate Covered Call Returns to Great Option Trading Strategies Home Page. Warren Buffett Zero Cost Basis Portfolio Current Equity Holdings: KO - shares KMI - shares BP - shares MCD - 30 shares JNJ - 25 shares GIS - 25 shares PAYX - 25 shares Open Market Purchase Price: Home Join Education Covered Calls Selling Puts Dividends Value Investing with Options!

How to Calculate Covered Call Returns 4 Ways to Track Performance When Writing Calls. In a nutshell, your stock position and your option position are each treated separately.

I want to make a few clarifying points in the above example: But don't forget to consider commission costs. Return from Calculate Covered Call Returns to Covered Calls Return from Calculate Covered Call Returns to Great Option Trading Strategies Home Page.