Beneficiary stock options

Well, generally inherited "stuff" in not a taxable event to the recipient. But are we talking about "exchange traded options", or some sort of employer stock incentive program?

This is a employer stock incentive program where I was listed as the beneficiary on. I had to exercise the option within a year of him passing. Also I have a Misc from his employer for the gain amount as well as a B from Etrade. If I enter both then I get hit twice.

The problem is that you are using the wrong basis for your report of sale. Assuming the B is only reporting the "out of pocket" amount then you would be double taxed. Once when you enter the MISC and then again whey you report the sale with a "too low" basis.

People come to TurboTax AnswerXchange for help and answers—we want to let them know that we're here to listen and share our knowledge. We do that with the style and format of our responses.

Here are five guidelines:.

Saved to your computer. Select a file to attach: Ask your question to the community. Most questions get a response in about a day. After you register or sign in, we'll return you to this page so you can continue your participation in the community. Submit a question Check notifications Sign in to TurboTax AnswerXchange or. Back to search results.

I was the listed beneficiary on my fathers stock options.

Do I have to may taxes on these inherited stock options? Asked by ctjdenver TurboTax Self Employed Options Edit Ask for details Archive. Answer The problem is that you are using the wrong basis for your report of sale. So, I assume you've entered the MISC somewhere. Now, go to the the "Stocks. If the B is not reporting the basis to the IRS , you simply type in the correct basis in the basis box of the default entry form. And you are done. If the B is reporting the basis to the IRS and is not using the correct basis, maybe only the amount you paid for the stock , then enter the B as it reads in the spreadsheet-like "fill in the boxes" default entry form but then click on the "Add More Details" box or maybe "Edit Details" , and the "Start" button, or maybe "Edit".

On the next page select the first optio n which is to " I need to add or fix info about this sale that's on my Form B. TurboTax will report the sale on Form "as reported by the broker" but will put an adjustment figure into column g of the Form, a code "B" into column f of the Form, and the correct amount of gain or loss which includes the adjustment.

If this is a "same day" sale then the most common result from entering the sale is a small loss due to selling commissions and fees.

I've given this same advise repeatedly and posted a pictorial step by step guide, for the sale of stock acquired via an RSU, but the process is applicable to any employer incentive stock plan sale , here https: Was this answer helpful?

No answers have been posted. This post has been closed and is not open for comments or answers. Here are five guidelines: When answering questions, write like you speak.

Money A2Z

Imagine you're explaining something to a trusted friend, using simple, everyday language. Avoid jargon and technical terms when possible. When no other word will do, explain technical terms in plain English. Be clear and state the answer right up front. Ask yourself what specific information the person really needs and then provide it.

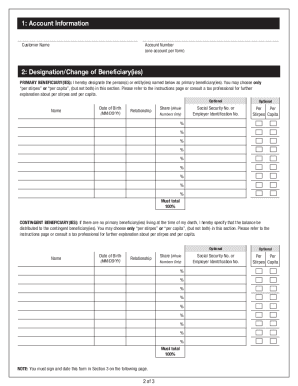

Stock Option Beneficiary Designation Form | Download Free ebooks

Stick to the topic and avoid unnecessary details. Break information down into a numbered or bulleted list and highlight the most important details in bold. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. A wall of text can look intimidating and many won't read it, so break it up. It's okay to link to other resources for more details, but avoid giving answers that contain little more than a link. Be a good listener. When people post very general questions, take a second to try to understand what they're really looking for.

Then, provide a response that guides them to the best possible outcome. Be encouraging and positive.

Inherited IRA Beneficiary Distribution Options - pupuzifecose.web.fc2.com

Look for ways to eliminate uncertainty by anticipating people's concerns. Make it apparent that we really like helping them achieve positive outcomes. To continue your participation in TurboTax AnswerXchange: Sign in or Create an account.