Selling options on leveraged etfs

Exchange-traded funds have found their way into countless portfolios, as investors of all types have embraced their cost-efficient, diversified exposure to virtually every corner of the global markets. Given their liquidity and access, active traders have increasingly expanded their playbook to include ETFs, accounting for a greater share of trades.

Changing Options Strategies When Trading Inverse ETFs - Show #086Leveraged ETFs use financial derivatives and debt instruments in order to consistently amplify the returns of an underlying index. This leverage is made possible through swap agreements and futures contracts [see The Ultimate Guide To Leveraged ETFs ].

But, there are many key risks that traders and investors should keep in mind before trading these securities, ranging from basic risks associated with leverage to complex risks associated with compounding returns on a daily basis.

Be Wary of Holding Overnight. Suppose that you purchase a leveraged ETF for The next trading session, the leveraged ETF falls 9. Compounding Works Both Ways. As the example above illustrated, volatile markets can lead to big losses for leveraged ETFs due to the fact that compounding works both ways.

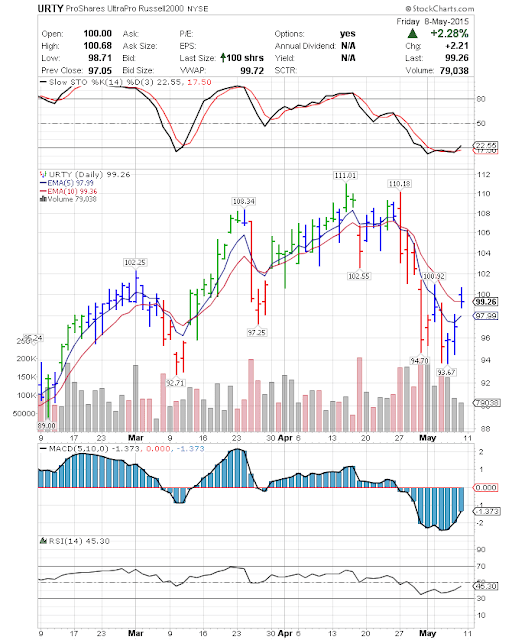

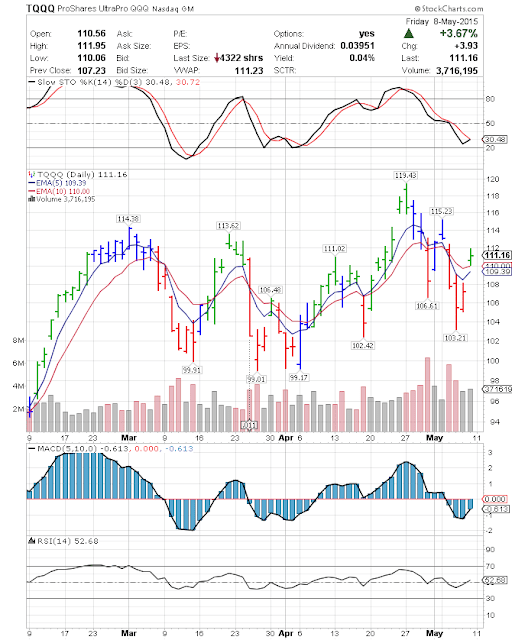

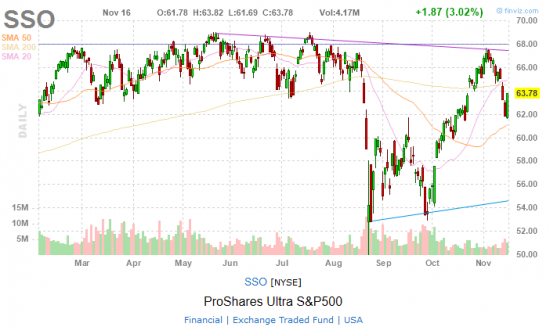

How to Trade Options on Leveraged ETFs

Suppose that the aforementioned leveraged ETF sways by the same 10 points every two days over a day period and you continue to hold it. While the underlying index may be dead even at Watch the Reset Period. The majority of leveraged ETFs reset their exposure dailywhich means they amplify returns over the course of a single day.

So, when considering the performance over a week, the performance depends largely on the path the ETF takes.

Volatility Strategy - VelocityShares - VelocityShares

Be Aware of Derivative Risks. Since they use financial derivatives, leveraged ETFs are inherently riskier than their unleveraged counterparts. The additional risks come in the form of counterparty risk, liquidity risk and increased correlation risk.

Meanwhile, traders also have to consider external factors such as the impact of leverage on portfolio volatility. For example, leveraged ETFs may not be appropriate for retirement portfolios trying to maintain a low beta coefficient.

Leveraged ETFs can be difficult to analyze and scary to some traders, but their usefulness makes them difficult to ignore in many cases, since they can be used to effectively trade on margin. That is, rather than selling options on leveraged etfs money from a broker, traders can simply buy a leveraged ETF with cash on hand in order to accomplish a specific trading objective.

However, leverage is a double-edged sword, with a bigger move down typing jobs from home free registration just as possible as a bigger move up. Leveraged ETFs may seem appealing to long-term investors, given their ability to amplify investment returns.

Long-term investors may want to instead consider purchasing traditional ETFs on margin, enhancing the leverage on their positions using call options, or binary options how to earn gold other more traditional techniques [see How To Take Profits And Cut Losses When Trading ETFs ].

Keep an Eye on the Costs. Leveraged ETFs can be more expensive than traditional ETFs, due to the complex strategies they must employ to obtain leverage. For example, the Direxion Daily Financial Bull 3x FAS, A- has an expense ratio of 0.

Inverse ETF Strategies | Finance - Zacks

Traders should carefully consider these costs and their impact on returns when buying and selling leveraged ETFs. Leveraged ETFs are a valuable tool for active traders looking to leverage their position without the use of margin or options.

However, there are many risks associated with using these ETFs that traders and investors should be aware of beforehand. Knowing these risks, long-term investors may want to shy away from holding leveraged ETFs, while active traders utilizing them should always be mindful of their position. No positions at time of writing. Click here to read the original article on ETFdb. Tired of supporting these people?.

Then start promoting the development of electric cars and better solar.

Markets close in 3 hrs. Stocks to Watch Target hit with a downgrade, Sears sinks, FedEx up on beat. ETF Database September 4, Fiction Leveraged ETFs use financial derivatives and debt instruments in order to consistently amplify the returns of an underlying index.

Keep an Eye on the Costs Leveraged ETFs can be more expensive than traditional ETFs, due to the complex strategies they must employ to obtain leverage. The Bottom Line Leveraged ETFs are a valuable tool for active traders looking to leverage their position without the use of margin or options. Leveraged, Financial ETFs Among Winners Daily ETF Roundup: Stocks Higher Despite Disappointing Chinese Data ProShares Adds 3x, -3x Financials ETFs Ten Commandments Of ETF Investing The Shocking Truth About Leveraged ETFs.

Recently Viewed Your list is empty. What to Read Next. Saudi king upends royal succession, names son as first heir. It's offensive Something else Thank you for helping us improve your Yahoo experience It's not relevant It's distracting I don't like this ad Send Done Why do I see ads?

Learn more about your feedback.