Exchange traded currency futures india

The growing integration of Indian financial markets and increasing flow of funds from across borders has increased the levels of currency exchange risk and volatility in the exchange rates.

There are a host of products available in the Over-the-counter OTC market such as forwards, swaps and options, available to them for hedging their currency risk and the markets for these are liquid.

In these volatile times there is an increased need to have wider choice of hedging instrument for the market participants to mitigate the exchange risk. Certain countries such as South Africa and South Korea have already introduced Exchange Traded Currency Futures ETCFs. They have coexisted with the OTC currency markets in these countries with full capital account convertibility.

Introduction of ETCFs in India is considered as a major step towards full capital account convertibility. Chart 1 depicts the volatility in exchange rates of US dollar and INR in the period to According to the Bank for International Settlements BIS Triennial Central Bank Surveythe share of India with daily turnover at USD 34 billion daily average in has increased from 0.

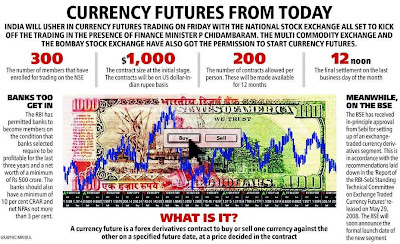

The depth in the domestic foreign exchange market is validated by the BIS survey data. The First exchange in India to launch the Exchange Traded Currency Futures ETCFs was NSE on August 29, BSE has also introduced its own ETCFs and Multi Commodity Exchange MCX is also planning to launch its own version of ETCFs. Banks are also allowed to become members of the exchange to participate in currency futures trade.

All resident Indians are allowed to participate in currency futures, only NRIs and FIIs are not eligible to trade. Currency futures are a standardized exchange-traded contract, to buy or sell a certain underlying instrument at a certain date in the future, at a specified price and the underlying instrument is a contract at a foreign exchange rate.

A currency future is a forex derivative contract to buy or sell one currency against the other on a specified future date, at a price decided in the contract. Contracts will be offered for a month, so those expecting delivery in the middle of the month may run the risk of keeping their position open for days.

An ETCF is traded in a stock exchange that has created a platform for this.

Trading of Currency Futures - Exchange TradingCurrency futures were first created at the Chicago Mercantile Exchange CME inless than a year after the system of fixed exchange rates was abandoned along with the gold standard.

Some commodity traders at the CME, who did not have access to the currency market in s established the International Monetary Market IMM and launched trading in seven currency futures on May 16, The IMM has baecome a division of CME. Other futures exchanges that trade currency futures are Euronext. A currency futures contract is a contract where the underlying instrument is a contract at a particular foreign exchange rate.

Currency futures are used primarily as a price setting mechanism rather than for physical exchange of currencies. The future date is called the delivery date or final settlement date. The pre-set price is called as the future price and the price of the underlying asset on the delivery date is called as the settlement price.

The futures contract gives the holder the right to buy or sell where as, an option contract which gives the holder the right, but not an obligation to buy or sell the underlying. Both the participants in the contract must fulfill their contractual obligations on the settlement date. However, such contracts do provide options to deliver the underlying asset or settle the difference in cash. The holder of a contract could exit from his commitment prior to the settlement date by either selling a long position or buying back a short position offset or reverse trade.

NSE - National Stock Exchange of India Ltd.

There is difference between investing in domestic assets and investing in foreign assets. Investing in foreign assets exposes the investor to the currency risk. The rate of return in terms of a domestic currency will vary in case the exchange rate at the time of buying the asset differs from the rate prevailing at the time of selling the asset.

If the domestic currency has weakened against the foreign currency, the exposure would result in a gain. If the domestic currency has strengthened against the foreign currency, the exposure would result in a loss.

In the Over-the-counter OTC market, trading of instruments directly between two parties.

Reserve Bank of India - Press Releases

This is in contrast to exchange trading, which occurs in facilities constructed for the purpose of trading such as stock exchanges. The OTC market presents investment opportunities for informed investors, but it is also subject to a high degree of risk.

An over-the-counter contract is a bilateral contract amongst two parties who arrive at a particular agreement that is to be settled in the exchange traded currency futures india. Forwards and swaps are most common examples of such contracts.

It is mostly done via the computer or the telephone. The bid-offer spreads are narrow reflecting the liquidity and efficiency of the market. The introduction of ETCFs is expected to increase the overall efficiency of the foreign exchange market.

The ETCFs is expected to bring about transparency in pricing, elimination of counter-party risk, more number of investor categories and market participants. Efficiency and Price Transparency - Futures and options exchange bring together divergent categories of buyers and sellers to determine foreign exchange prices. The mechanism of price discovery is efficient because of transparent trading. When the trading is ib commissions forex electronically, the prices of ETCFs are disseminated worldwide.

Elimination of Counterparty Credit Risk — ETCFs have the exchange clearing house as the counterparty to every trade. Then the, Market participants then need not evaluate the credit worthiness of multiple counterparties. Accessible to All Market Participants — The access of direct trading in foreign exchange will no more be restricted to large commercial banks and their big corporate customers.

Individuals, small and medium-sized banks and corporations, investment funds and governments can buy and sell currencies for future delivery or cash settlement.

Access to all market participants is an important characteristic of ETCFs. Currently, the ETCFs in India are traded in two exchanges i. In some time the ETCFs are expected to be traded in many other exchanges such as the MCX. In case of monopoly, flexibility and innovation will be limited. In case of multiple exchange trading, there will be a high level of competence and will lead to lower trading charge.

As the currency futures market matures, many opportunities such as spread trading and cross-spreading are expected to emerge. The market is a cluster of different players with different objectives. The central bank ensures a balance of the exchange rate by regular intervention in the forex blackberry bold no call forwarding option in order to maintain the export-import trade.

Figure 2 explains the product specification of the currency derivative traded in the BSE as BSE CDX. The ETCFs could also be used as an asset class to diversify the investment portfolio by some investors. There are some issues pertaining to this diversification that are explained below. The sector to be benefit the most are those sectors which import or export in large quantities.

These are the industries which are affected by the increasing volatality in the movement of rupee. Figure 3 depicts the exports of select companies in various sectors as a percent to its sales. Click to view enlarge.

The sector was most affected when the US dollar had appreciated from levels of Rs 45 to levels of Rs 38 in the past. There is expected to be a positive impact on the sector due to the depreciation in the Indian rupee from levels of Rs 39 to Rs Oil and Gas — The market participants of the sector import crude oil and exchange traded currency futures india processed and refined petroluem products.

Chart 4 depicts the price of crude oil in Indian rupee and in US Dollar for the period April'Sept' Pharmaceuticals — Most of the Indian participants operate in the gerneric market space and export most of the production.

The share of exports is expected to reach 62 percent of the total sales by Exchange Traded Currency Futures Date Published: Introduction The growing integration of Indian financial markets and increasing flow of funds from across borders has increased the levels of currency exchange risk and volatility in the exchange rates.

Reserve Bank of India, Sebi to extend currency futures trading time

Chart 2 depicts the movement of Indian Rupee and US dollar for the period Jan'Sept'08 Figure 1 shows the dell stock buyout date of dollar for the period According to the Bank for International Settlements BIS Triennial Central Bank Surveythe share of India with daily turnover at USD 34 billion daily average in has increased from 0.

Understanding Exchange Traded Currency futures ETCFs Currency futures are a standardized exchange-traded contract, to buy or sell a certain underlying instrument at a certain date in the future, at a specified price and the underlying instrument is a contract at a foreign exchange rate. History of CFs Currency futures were first created at the Chicago Mercantile Exchange CME inless than a year after the system of fixed exchange rates was abandoned along with the gold standard.

Explaining currency risk There is difference between investing in domestic assets and investing in foreign assets. Over-The-Counter OTC Trading and markets In the Over-the-counter OTC market, trading of instruments directly between two parties. Advantages and disadvantages of CFs The ETCFs offer different advantages over OTC market such as Efficient price discovery Elimination of counterparty credit risk Access to all types of market participants. Standardized products Transparent trading platform.

The ETCFs also have some disadvantages when compared to the OTC market such as Standardization — It is not possible to obtain a perfect hedge amount and timing. Cost — The forwards have no upfront cost, but margining requirements effectively drive the cost of hedging in futures up.

Small lots- It is not possible to hedge small exposures generally. Issues regarding ETCFs The contract is settled with cash, which makes it of limited volume for hedging. FIIs and NRIs are not permitted to access this instrument. There could be issues regarding deregulation as Indian entities can have exposure to external value of the rupee without having an underlying foreign exchange exposure. Multiple exchanges for ETCFs Currently, the ETCFs in India are traded in two exchanges i.

Oppertunities in ETCFs As the currency futures market matures, many opportunities such as spread trading and cross-spreading are expected to emerge. Figure 2 explains the product specification of the currency derivative traded in the BSE as BSE CDX CFs as an investment option Asset class The ETCFs could also be used as an asset class to diversify the investment portfolio by some investors.

There are some issues pertaining to this diversification that are explained below Exposure in currency futures entails a holding cost in terms of margin.

In India, one cannot hold foreign currency for a long time, the contract has to be settled and squared-off in cash. Foreign institutional players are not allowed to take exposure in currency derivatives. Another issue in investing in ETCFs could be the investment-focus of an investor. If an investor wants to invest heavily in India, then the investor would expose himself to an international currency fluctuation risk by trading in currency futures.

An investor would build some expose to ETCF, if he has a clear view on the economy and is confident about the predicted trend in the exchange rate. Impact of currency fluctuations might devalue the asset. It will be riskier for an investor to profit from ETCFs in the short term. The ETCFs market evolves, certain sections will see value in it and many would benefit from it.

Industries to benefit from the introduction of ETCFs in India The sector to be benefit the most are those sectors which import or export in large quantities.

Chart 4 depicts the price of crude oil in Indian rupee and in US Dollar for the period April'Sept'08 Chart 5 depicts the total import of crude oil for the period Chart 6 depicts the value of exports of pertroleum products for the period Metals —The market participants import raw materials such as coal and ores. There are some particiapants who export iron ore and also finished products.

Textiles — The sector accounts for nearly 20 percent of India's total exports. There are various participants who have exclusive units to export textiles to foreign countries.

Trading houses — There are participants who export to various countries and get most of their revenue in foreign currency. Conclusion The gains likely from the introduction of ETCFs in the Indian context are listed below: An additional tool for hedging currency risk. Provide a platform to retail participants of the market Efficient method of credit risk transfer through the exchange.

Creates a market to facilitate large volumes of transactions Development of domestic foreign exchange market. Show signs of gradual movement towards fuller capital account convertibility "ETCF will provide further depth and breadth to the market and fulfill their intended objective as an effective risk management instrument", said Shyamala Gopinath, deputy governor, RBI. BACK TO TOP RETURN. Exchange Traded Currency Futures.