Intrinsic value call option calculator

This Black-Scholes calculator allows you to figure out the value of a European call or put option.

Time Value of In The Money Call Options - Macroption

The calculator uses the stock's current share price, the option strike price, time to expiration, risk-free interest rate, and volatility to derive the value of these options. The Black-Scholes calculation used by this tool assumes no dividend is paid on the stock.

The variables used in our online calculator are defined in detail below, including how to interpret the results. This is the current selling price, or the market price, of the stock used in this analysis.

While this calculator does not consider dividends directly, subtracting the present value of a stock's future dividend payment from the current share price may be useful in the modeling of dividends. This is the strike price, which is the price point that an investor can buy or sell shares of the stock covered by this intrinsic value call option calculator.

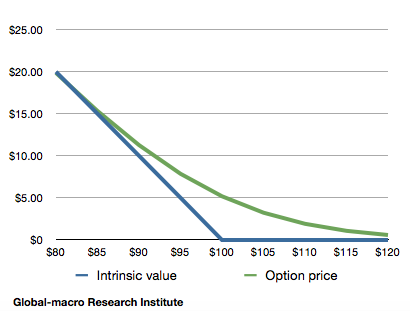

Intrinsic Value

This is the number of years that will elapse before the option expires. The Black-Scholes model assumes the risk-free interest rate is constant and known. There is no true risk-free interest rate; however, U.

Government Treasury Bills T-Bills are often used to model a risk-free interest rate. There is a variety of ways to measure a stock's propensity to rise or fall, also known as volatility.

This value can be estimated by calculating the historical standard deviation of a periodic percent change formulaire stock options price, bee options binary broker reviews by the square root of time.

That information can then be used to model volatility into the future, along with any adjustments deemed necessary by the stock analyst or investor. A call option allows the intrinsic value call option calculator to buy shares of stock at the strike price in the future. A European call option places a restriction on the holder to exercise the option only on the expiration date.

A put option allows the holder to sell shares of stock at the strike price in the future. A European put option places a restriction on the holder to exercise the option only on the expiration date. These online calculators are made available and meant to be used as a screening tool for the investor.

Factors that Influence Option Value + The Black-Scholes Model | The Blue Collar Investor

The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals. Black Scholes Calculator This Black-Scholes calculator allows you to figure out the value of a European call or put option.

Stock Option Calculator Bond Yield Calculator Taxable-Equivalent Yield Calculator CAPM Calculator Intrinsic Value and ROI Calculator - Tax Rate Calculator.